This calculation is widely used by companies to determine how effective their marketing and customer acquisition costs are, as well as determining the viability of the business for many startups. CLV is about determining the economic value a customer brings over the lifetime of that customer.

What is a customer worth?

Let's say you spend $1,000,000 in advertising, direct mail and having sales people cold call potential customers. This brings you 1000 customers. That's great, or is it? This is what CLV attempts to discover. If each of those people only spend $10 and then never return, you'll eventually run out of money and close down. If each of those people spend $100,000 and return, it's obviously great! However, what happens is each of those people spend $25 per month and you lose 20% of them per year? It is just this sort of complexity that requires using the CLV calculation.

So...what exactly does the CLV number represent?

The CLV number represents what that customer spends with your company, adjusted for time, and after the costs of both acquisition and the products they receive, during the lifetime of them being a customer.

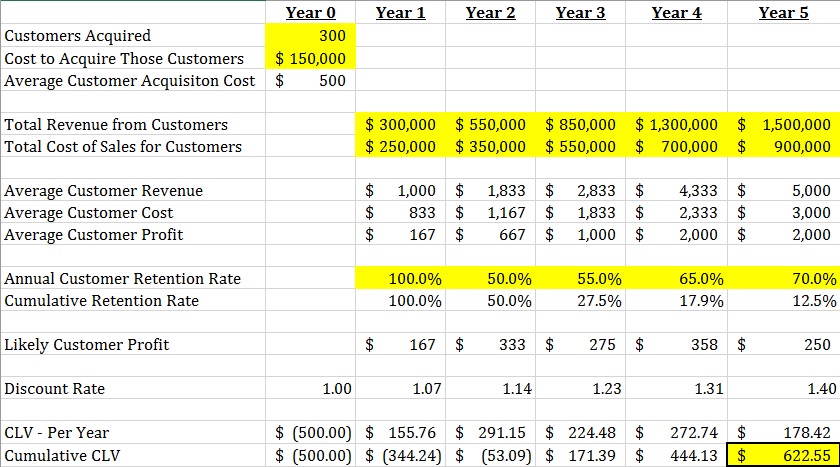

Discount Rate

The discount rate is a rate that results from the value of having the money now versus at a point in the future. It represents many potential items: loss of potential investment of those dollars prior to receiving them, potential risk in never collecting the revenue, inflation and many other disadvantages to not having the money immediately. Historically, I've used 7% and so I'll continue using that in this example.

Putting it simply, if you loan someone a $100 and they'll pay you $10 per year, then you'll end up with $100, but it isn't "worth" as much as if they paid you the $100 tomorrow, now is it?

This seems really complex...

It is a bit, though if you take your time and really look at it all, it'll start to make a lot of sense. Once you understand it though, it can be very interesting and powerful for examining companies.

Example

Let's say we're starting a software company and we give heavy discounts in the initial years for customers. We spend $150,000 on direct mail and sales people to get 300 customers, which is an average customer acquisition cost of $500. Quite happily, we bring in $4.5mm in revenue over the next five years and spend $2.75mm on costs, in addition to the acquisition costs. After adjusting for a 7% discount rate, we've made $622.55 per customer, which is our CLV. This is all demonstrate in an excel sheet, which you can download and modify here.

Target Markets

This process becomes especially important when targeting niches and determining various target markets. Through examining sales estimates, you can determine if it's worth pursuing specific market segments. Perhaps millionaires would spend an average of $1000 one time with your organization, but the average student would spend $50 per month for five years, and at one-third the cost to acquire.